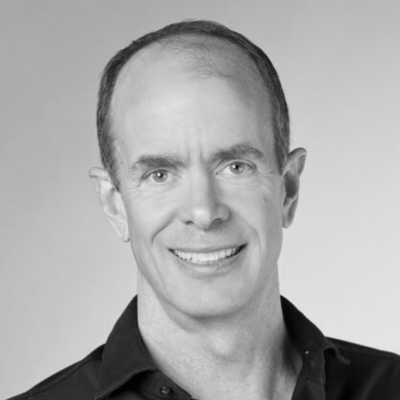

Tony Lent has 28 years of experience as a pioneer and innovator in financing sustainability with a primary focus on climate. Mobilized more than $2bn to the low carbon transition. Areas of expertise: climate finance, renewables scale up, nature-based solutions, agriculture transition, zero-carbon fuels, green chemistry, emerging markets.

Co-founder, Capital For Climate, 2019-present - an intelligence platform and investor communities to guide capital to the highest leverage opportunities on the science-based pathways to 1.5C.

Co-founder and CEO of Swift Current Energy, 2016-2019, Senior Advisor 2019-2021, a leading North American renewables developer and investor.

Co-founder Javelin Capital, 2014-2018, a boutique investment bank focused on M&A in renewables, distributed energy, and low carbon fuels.

Senior Managing Director, Wolfensohn Fund Management, 2010-2014, private equity investing in renewables and financial inclusion in Brazil, Eastern Europe and India.

Co-founder, US Renewables Group, Managing Director, IC member, 2003-2010, a pioneer private equity fund focused on renewables scale up. Investments in technology scale ups, renewable energy projects and developers, first and second generation biofuels.

Co-founder EA Capital, 1993-2002, one of the earliest strategic advisory firms focused on structuring pioneering vehicles for sustainable investment. Developed first of a kind funds and funding mechanisms in biodiversity, renewables, sustainable forestry and carbon