The Disaster that is EU Energy Policy

In a fiscal response not seen since the commencement of the pandemic, European nations are announcing a slew of support measures designed to bring down the energy cost for families and small businesses. Sweden and Germany came out first and will be followed by Finland. Liz Truss, the likely successor to Boris Johnson as UK Prime Minister, apparently has a plan to bring down energy costs, heading to levels as high as 15% of median income. These policy responses are designed to help alleviate a cost of living crisis without precedent in our professional lives as the globe deals with an energy crisis amplified by the transgressions of Vladimir Putin but is rooted in an energy transition that is going horribly wrong. The result is higher fiscal deficits in the face of aggressive monetary tightening. A contradiction that would have Keynes turning in his grave.

The funding of these programs is driven by windfall taxes on energy producers who currently do not use gas. They include wind, solar, nuclear and coal. The first three should sound familiar as they are the foundation of a renewable energy future. In an ironic twist that should not be lost on anyone who focuses on the investment implications of the energy transition, enormous taxes will be levied on the profits of renewable energy companies in response to a fossil fuel embargo that has left the EU short of gas as the winter months approach. In response to a supply shortage of their own making, the EU’s answer is to tax the companies that will drive Europe’s energy future and depriving them of an opportunity to expand. The result is a golden age for coal, the inevitability of a recession driven by gas rationing and an EU that will continue to miss its carbon output targets, potentially for years to come.

The indefinite suspension of Russian gas supplies via the Nord Stream pipeline, a response to a G7 proposal for price caps on Russian oil, should hardly be considered surprising. The risk of this spiked exponentially with Russia’s invasion of Ukraine, but one does not need the value of hindsight to appreciate the strategic vulnerability that Europe, especially Germany, faced. Brussels reached a consensus to utilize Russian gas as the transitional fuel as Europe pushed toward a renewable energy future by the mid-2030s. European energy policy, formulated under the leadership of Angela Merkel, centred around using gas from a historically unreliable partner as EU power production shifted towards predominantly wind and solar projects with dubious storage technologies whilst removing nuclear energy from the conversation. This has left the EU remarkably susceptible to swings around finite gas supplies.

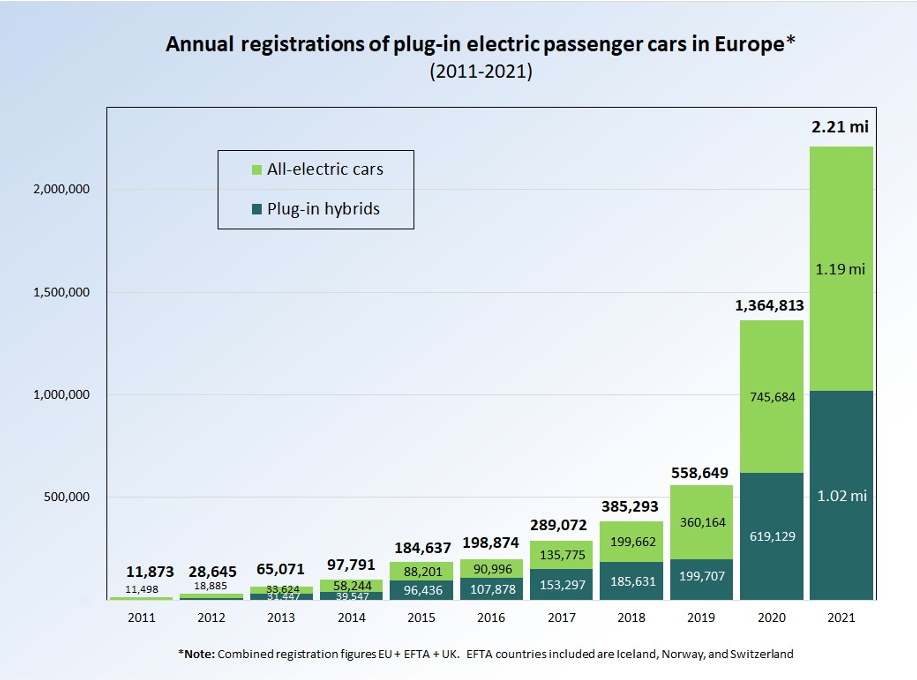

This transition was also fast-tracked, with structural impediments to funding fossil fuels still required to power over 98% of EU vehicles. There are over 250m vehicles registered in the EU, and 2021 saw approximately 2.2m new EVs and Hybrids hit the road. While no one doubts the exponential growth likely in the years ahead, the disconnect between energy policy in the next five years and the practicalities of hydrocarbons that will dominate the EU and global economy for the next 15 years is glaring.

The flaws in EU energy policy are vast, but the framework is well-intentioned. The urgency of the need for the global economy to transition away from fossil fuels to clean renewable sources is scientifically unquestionable. However, the practicalities of achieving Net Zero is the world’s greatest technological and economic challenge. Unfortunately, global policy is currently sadly lacking.

China’s strategy is comprehensive but inward-looking. The US approach has improved under President Biden, but the Republican Party’s scepticism about Federal Government involvement and recent Supreme Court decisions that have neutered the influence of regulatory bodies like the Environmental Protection Agency will create barriers to change. The EU has failed to appreciate that this economic transition will take decades and that attempting speedy solutions will cause market disruptions with dire economic consequences.

There are multiple requirements to achieve this energy transition. First and foremost is a healthy global economy that must be permitted to function harmoniously as decarbonization evolves. There has to be an appreciation that this is an energy evolution, not revolution, and rolling recessions driven by energy shortages only make achieving Net Zero much more difficult.

This is precisely the position the EU now faces. Putting the challenges of rampant inflation aside, the flaws in EU energy policy will lead the EU into a harsh recession in the quarters ahead. Despite the best efforts of fiscal support to ease the pain for consumers and small businesses, gas rationing for industrial companies in Germany will lead to the sharpest economic contraction since 2011. When Russian gas supplies normalize is anyone’s guess, but without ending Russian hostilities in Ukraine, it is difficult to see this anytime soon.

However, it is so much bigger than this. Germany’s decommissioning of its nuclear energy programs post-Fukushima was politically sound at the time but has proven to be one of the great policy blunders. Tacit support for the private sector defunding fossil fuels when the EU won’t reach peak oil demand until well past 2035 will have continued consequences for the EU economy. Policy actions and investment trends imply that oil and gas supplies will continue to tighten over the next five years, yet the demand for hydrocarbons for transportation and energy consumption as the swing factor could lead to the current energy crisis being repeated time and time again over the next decade. There is no path to be anywhere near Net Zero for ships or aircraft in the next 15 years, and by 2035, there will be more than two billion combustion engines on global roads. EU energy policy is influencing supply over the next five to ten years, whilst the demand transition could take two decades. This is bound to create enormous distortions.

Putin is central to this current EU energy crisis, but spiking prices were bound to happen anyway.

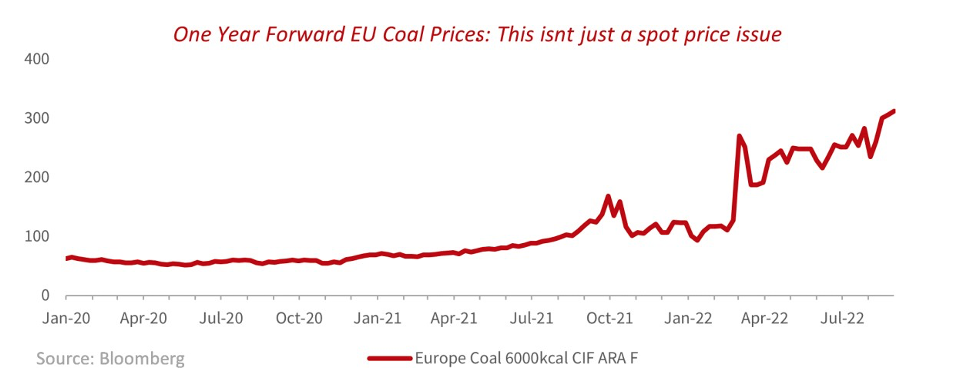

The consequences are more than economic. According to the Financial Times, Germany intends to postpone by a year a planned €5/tonne increase in the price of CO₂ that was due to come into force next January. Postponing carbon tax increases and levying unprecedented taxes on renewable energy is an insult to the true intention of EU energy policy, which is eradicating the use of fossil fuels and promoting renewable energy. With severe doubts over the speed and success of the re-commissioning of German nuclear facilities, is it any wonder that one year forward, coal prices are at record highs? This is not a scenario where energy producers are scrambling to cover an imminent fuel shortage; this is anticipating that the demand for coal will last well into 2023 and beyond. As such, it is difficult to argue that coal has not reasserted itself as a dominant participant in the EU energy mix.

What is gravely concerning to those of us who believe in the urgency of the energy transition is how quickly this priority has been downgraded in the face of spiking energy prices. This goes to the heart of the difficulty of decarbonization. Consumers across the developed world, in particular, are passionate about the need to remove fossil fuels up until the point when it inconveniences them. Rightly so, but the vast majority of citizens across the globe will not be prepared to experience energy poverty to play their part in protecting the planet. The current energy crisis implies no way to accelerate the energy transition without enormous costs for all stakeholders. The only solution is a gradual approach that takes decades and not years. As stated, a prerequisite for Net Zero is a healthy global economy, and we will not have that if the EU lurches from one energy meltdown to the next.

Whether we have the time to achieve this energy transition efficiently to avoid the global warming that will systemically harm our planet is the existential question of this decade.

The rampant inflation that has swamped the global economy has its roots in the COVID era supply chain disruptions and unprecedented fiscal spending programs that put hundreds of billions of dollars in the hands of the bottom 80% of income earners. This cohort has a high propensity to spend, so pandemic support packages were spent and underpinned the inflation pressures we witness today.

Most countries have seen their fiscal deficits shrink in 2022 as the pandemic has been put behind us. That said, Russia’s invasion of Ukraine had underwritten a narrative of larger EU defence budgets that would support EU activity despite tightening financial conditions across the globe. This idea soon evaporated as energy prices began to spike, and it became clear that this energy crisis had the potential to rock the EU industrial base and pressure households under the weight of enormous heating bills this winter. Despite a steep German yield curve, the market consensus is for an EU recession starting in Q4.

This flies in the face of a hawkish ECB that faces the unenviable task of looking to raise interest rates into an energy crisis and pending recession. While I would argue that the ECB should embrace the approach of the Bank of Japan and accept that inflation is beyond the central bank’s control, ECB President Christine Lagarde will likely oversee a 75bp increase in the policy rate this week. This has the stench of the policy errors by the ECB in 2008 and 2011 when they raised rates heading into a recession.

Fiscal support packages being proposed across the EU probably makes this decision somewhat easier. Direct payments to citizens won’t cover the entirety of the increase in the cost of power, but it will be spent at a time when inflationary pressures are at their worst. Despite the urgency of dealing with EU energy policy, this certainly does not help the ECB’s efforts to keep inflationary expectations in check. As such, aggressively raising interest rates into fiscal support programs will be likely in the months ahead.

The Federal Reserve is keeping a close eye on the energy crisis in the EU. That said, until it directly affects the US economy, they will not alter their policy trajectory and, therefore, the performance of US equity or credit markets. I wrote the following last week

There are many examples where international turmoils have failed to garner a negative response from US assets. The Asian crisis was brewing for 15 months before the Russian default, and the subsequent balance sheet pressure at Bear Sterns and Lehmann Brothers prompted the Fed to respond. Historically, financial assets in the United States are wedded to domestic factors, and until there is a legitimate follow-on effect that threatens earnings or credit quality, the market tends to ignore the leading indicators that are events offshore.

Unless international factors are going to lead to an earnings deterioration or a hit to credit quality, US investors will ignore foreign instability.

A wise client once asked me this question back in 2011

Does a fund manager in St Louis stop buying Google because of what is happening in Greece?

In isolation, historically, they do not.

The problem for global asset markets is that they are recalibrating their narrative to one where the Federal Reserve will likely be on hold for much of 2023. This creates a horrible scenario for risky assets in the weeks ahead that have to deal with a dire energy outlook for the EU and a more hawkish Federal Reserve. Couple this with the most seasonally weak period of the year, and the prospect of a sharp depreciation in EU assets looks assured.

Risk assets will not start to turn around until it becomes clear that the most hawkish outcome is being priced into US fixed income markets. For me, that would be a terminal rate of above 4% and no rate cuts priced into 2023. While some circles will see the prospect of EU support packages for consumers through a constructive lens, this will a) not be enough to cover the consumption hit for EU families and b) won’t be a positive driver of global beta in the face of a hawkish Fed.

Energy is something we all take for granted. For most of us, the lights just work, and we don’t give it a second thought. My energy bill in Chicago is $195 per month, and I must concede that I had to look it up today because it is a direct debit that I was ignorantly unaware of. European and UK families and the small businesses that dominate communities do not have that luxury. The next several quarters will be a difficult time, even if governments provide generous fiscal support to help with an energy crisis exacerbated by Vladamir Putin but rooted in a naïve energy policy that failed to take into account the enormity of attempting to decarbonize the global economy.

The EU and UK are heading into an onerous recession driven by high energy prices and the prospect of gas rationing that could devastate the European industrial base. For equity and credit investors, how can you possibly have any visibility on earnings when your companies cannot tell you how much power they can access or if the price of power will remain north of the equivalent of $1000 per barrel? Given this could last several quarters, it is clear to me that investing in European companies at this time is simply too risky.

Where would the SPX be trading if electricity prices were that high in the United States? I have asked this question of multiple clients in the past week, with the consensus being 3200 and below. European risky assets are not reflecting an elongated energy shock.

This will lead to a continual de-rating of both the Euro and GBP. Structural energy deficits and growing fiscal deficits will continue to lessen the attractiveness of both currencies, which could face the nastiest recession since 2008.

There is no quick solution outside of an immediate cessation of hostilities between Russia and Ukraine. The prospect of this is beyond the scope of my thinking, but it is clear that Mr Putin has created enormous economic pressure on the EU as winter approaches. Investing in the EU based on hoping the Kremlin will do the right thing is not an investment strategy.

That said, EU energy policy was deeply flawed before Russia’s economic extortion. Spiking energy prices were inevitable as German policymakers, in particular, failed to appreciate that the global economy will still rely on hydrocarbons for another two decades and that starving supplies of fossil fuels today will lead to rolling price disruptions. Without nuclear playing an appreciable role, energy shortages and spiking prices will be commonplace, making a pathway to Net Zero incredibly problematic.

A healthy global economy is a prerequisite to achieving our sustainability objectives. A functioning global economy will allow for the time and capital required to transition from fossil fuels successfully. If European governments are forced to use coal, defer carbon taxes or tax renewable companies to pay for record energy prices, how is this helpful in achieving our climate aims? There must be an appreciation that this is an evolution and won’t happen overnight. Without this pragmatic thinking, the economic consequences of energy disruptions like the one Europe faces could derail the entire agenda.

Disclaimer

Note: The terms of this report are subject to and qualified by the terms of the Subscription Agreement between VFTP Financial Publishing LLC (“VFTP”) and client receiving this report. Unless otherwise specified herein, in the event of any conflict between the terms of this Disclaimer and the terms of the Agreement, the terms of the Agreement shall govern. Defined terms not otherwise defined herein shall be as defined in the Agreement.

All Sources Bloomberg unless stated Analyst Certification

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by that analyst herein.

Required Disclosures

The analyst named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report. Additional information will be made available upon request.

Global Disclaimer

This report is for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the Recipient agrees to be bound by the terms and limitations set out herein. The information contained in this report has been obtained exclusively from public sources believed by VFTP to be reliable and the opinions contained herein are expressions of belief based on such information. Except as otherwise set forth herein or in the Subscription Agreement, no representation or warranty, express or implied, is made that such information or opinions is accurate, complete or verified and it should not be relied upon as such. Nothing in this Report constitutes a representation that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. It is published solely for information purposes, it does not constitute an advertisement, a prospectus or other offering document or an offer or a solicitation to buy or sell any securities or related financial instruments in any jurisdiction. Information and opinions contained in this report are published for the reference of the recipients and are not to be relied upon as authoritative or without the recipient’s own independent verification or taken in substitution for the exercise of the recipient’s own judgment. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. Except in the case of fraud, gross negligence or willful misconduct, or except as otherwise set forth herein or in the Subscription Agreement, VFTP does not accept any liability whatsoever for any direct or consequential loss arising from any use of the materials contained in this report.

Distribution or publication of this report in any other places to persons which are not permitted under the applicable laws or regulations of such places is strictly prohibited.

© 2022 VFTP Financial Publishing LLC

Paul has over 25 years’ experience as a financial market strategist. In 2011 he founded View from the Peak, a global, multi-asset class research platform that focuses on the interactions between public policy, economic trends, technology, and geopolitics. In 2015, Expanding on the thought leadership stemming from View from the Peak, Paul launched the Expert Series. What started as a series of ad-hoc interviews became leading commentary on the mega thematics of China, Climate, Digitization and Demographics. The firm has a network of hundreds of think tank fellows, academics, corporate leadership, and independent strategists that cover technology developments, geopolitics, trade, regulation, equities, the energy transition and more. US-China Series was launched in 2018 and Climate Transformed was born in 2021 from the desire to apply the multimedia intelligence model to understanding the biggest existential challenge our world has ever faced. Prior to this, Paul spent 15 years in Investment Banking and Asset Management. He was the Managing Partner of Corus Capital Management, a multi-strategy Asian focused hedge fund based in New York. Before forming Corus in 2005, he held roles at Caxton Associates, Moore Capital Management, Goldman Sachs and Macquarie Bank. Paul holds a Bachelor of Economics and Politics from Monash University in Melbourne, Australia.